“Sometimes it’s the data that isn’t there that points to the data that’s important.”

That’s likely the best analytical advice I have ever gotten. It points out the possibility that a lack of data can actually highlight areas worthy of investigation. This point was well illustrated by the annual Google Analytics Summit held earlier this month in Mountain View, CA. Despite the cheery Google Analytics revelations about what 2014 has in store for businesses, there was one area Google kept rather mum about – organic traffic.

In one aspect, this makes sense. Google knows paid traffic is king: both for businesses and for Google. Paid traffic is the life-blood of Google and, as such, deserves a whole lot more attention than organic (or “free”) visits from any subsequent Analytics launch. On the other hand, we all know organic segments shouldn’t be ignored. Organic segments are important, because they supplement the consumer picture that is painted by Analytics. Sometimes what works for organic segments can be successfully utilized and applied to paid segments. Sometimes, data from paid visitors can be used to enhance and improve the experience of organic visitors as well. In many ways the relationship between organic and paid site traffic is a symbiotic one, and it is a rare SEO or SEM who doesn’t seriously study up on their organic visitors every chance they get!

Why the cold shoulder from Google?

As many PPC managers have lamented over the years, the rate at which keywords are showing up in reports as “not set/not provided“ has seemingly grown by the day. As of September 23, Google made a huge transition by making encrypted HTTPS searches the default setting. This will stand to further hinder the collection of keyword data by site owners. Depending on your specific industry segment and customer base, the upgrade stands to have a varying degree of impact upon your SEO and SEM strategies.

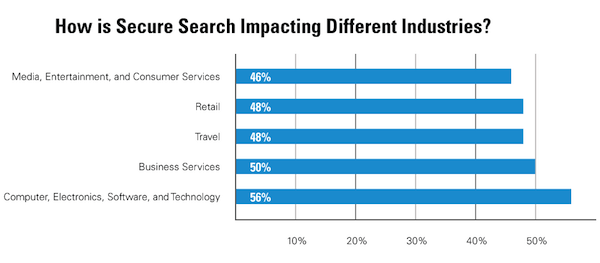

A study from BrightEdge found that as much as 56% of keyword traffic is “not provided/not set” in some industries due to the newest update. This metric was recorded for the tech crowd, and this group was found to have the highest “not provided” level compared to other market categories. Just as it makes sense to see Google is focusing more on its paid visitors, it also makes sense to see tech segments earning the lion’s share of null keyword data from Google’s secure switch from a top-level analysis.

Many individuals comprising the so-called “tech crowd” are savvy people. They know (and have known) better than to leave searches un-secured. It is also more likely that members of this group have customized their security settings already. Google’s newest security enhancement merely ensures that any information from this segment that might have made it through “the cracks” is now even harder to locate.

Other industries affected by the update include: retail (48%), travel (48%), business services (50%) and media/entertainment/consumer services (46%). Even industry leaders like Search Engine Watch saw spikes in their null keyword data. The company reported a 47.1% (not provided) average for site traffic between June and December of 2012. Just 6 months later, this number rose to over 60% between January and June of this year.

Chart from Search Engine Watch: “Google ‘(Not Provided)’ Traffic Highest for Tech Industry Brands at 56% [Study]” by Jessica Lee

So how are we to handle (not provided)?

There are a few ways to counteract “not set” keyword data. It should be kept in mind that Google has been experimenting with query security for some time now, but more aggressively since 2010. Even articles from early 2012 outlined ways to develop alternative methods to locate protected keyword data. These are still helpful resources to recover missing pieces of the picture in front of today’s data professionals.

An article by Ben Goodsell of Search Engine Watch provides a helpful resource. He includes detailed instructions about how to customize Google Analytics Reports in light of data from Google Webmaster Tools to show information about discrepancies between the two programs. By paralleling the information about visits and clicks from across platforms neatly in one place, you can begin to understand to what extent the “not provided” crisis has carried over into your own data. As long as your Google Analytics and Webmaster Tools accounts are associated with each other, this is a great way to gain insight into what keywords are becoming less visible in your reports.

Hey, what about those 14 cheerful announcements?

Even though Google’s decision to tighten up security makes it harder for professionals to obtain keyword data, there are some ways that Google is trying to make marketers’ lives better.

The rundown looks like this:

- Dynamic tag firing is now the standard for event tracking (for those of you using Google Tag Manager)

- Mandatory service level agreements for Google Tag Manager Enterprise

- Cross Device Measurement – enhanced features to better understand the decision making process of consumers across devices

- Better options for Management UI and API across organizations and employees for those who use it

- Acquisition Overviews with an enhanced focus on the role of goals, pages and traffic (versus, of course, enhanced insights into organic searches and keywords)

- Optimized “Audience Overview” configurations and ability to drill down in a more progressive order

- Better demographic representation in Google reports

- Demographic data in ALL reporting aspects

- Third-party data integration and the enabling of queries in SQL

- DoubleClick integration

- Attribution Modeling

- Google Play and Analytics integration

- Two-week Google Analytics Academy course slated for launch in October 2013

- In-product help videos

So, there you have it: the cool and, perhaps, not-so-cool developments from the most recent Google Analytics Summit. If you’re a SEM professional, the increase in keyword (not provided) data likely ceases to surprise you, but it also requires advancements in PPC and SEO strategies.

As professionals working in an ever-changing environment, curve balls, such as the one seen in organic keyword data, are likely to continue. The best action to take is to assess how these changes stand to specifically impact your industry and market segments, and optimize where you can with what you have.

The 14 changes in Analytics announced by Google are likely to offer insights that were previously not available or less available. The changes can definitely help to draw attention to aspects of data that might have been previously overlooked or under-emphasized. Perhaps these advancements, over time, will stand to lessen the blow of increased not provided data?

What do you think? How have you seen (not provided) keyword data change in your industry? How have you developed ways to cope with the growing absence of organic keyword data? Do any of the new areas enhanced by Google offer more interesting data compared to organic queries? What will be “the next big stat” to focus on for SEMs and SEOs?